Just what part of mortgages try changeable-price inside 2022?

Inside the mid-2022, adjustable-rate mortgage loans made nearly ten% of all of the brand new home loan applications, with regards to the Home loan Lenders Organization (MBA).

Which can maybe not appear to be much, however it is a much better show out-of Sleeve financing than simply we’ve seen once the 2008. And it’s really easy to understand as to why. Having Sleeve cost hanging over 100 basis issues (1%) less than repaired home loan cost, homebuyers for the 2022 try leverage varying rates finance to reduce their money and you may pay for more expensive belongings.

Palms tend to be smaller in the short term

Considering Freddie Mac, the typical rates to have a thirty-12 months, fixed-rate home loan (FRM) try 5.54% during the day stop elizabeth day, an average rate to own a beneficial 5/1 Sleeve was only 4.29 per cent.

The reduced-rates Arm pattern is nothing the. Throughout 2022, whilst rates of interest has actually risen sharply, average changeable prices provides existed to a portion section or higher below repaired financial prices.

A great 5/1 Case form the loan has its 1st repaired rates to possess the original 5 years and then the rates can be to evolve after a year towards leftover twenty five years. Other popular choice were good 7/step 1 or ten/1 Sleeve, definition your first rate is restricted getting seven otherwise a decade earlier is to change.

So you could rescue lots of money during the monthly payments because of the choosing a supply, at the very least across the very first four so you’re able to a decade of one’s mortgage. As an alternative, you could manage a much better, more expensive home with the same payments you’ll generate for the an effective less, fixed-rates financial.

Needless to say, a supply actually for everyone. If you intend to remain in your home more than ten age, an arm might not be the top. However if a variable-rate mortgage works for your financial situation, you can get a much better try from the affording property these days.

Adjustable-rate home loan trend throughout the years

Adjustable-price mortgage loans was indeed massively well-known before 2008, within one point making up more than a 3rd of your complete home loan sector. However, these people were plus riskier to possess consumers.

Before houses freeze, Sleeve cash advance near me open on sunday funds didn’t have an identical defenses they do today. This means that, people mostly avoided them over the last , adjustable-rates financing never constructed over ten% of the home loan markets.

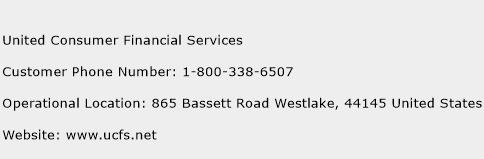

1 Mortgage Bankers Connection “Graph of your own Day: Adjustable-Speed Mortgage (ARM) Loan Fashion. dos,3 Freddie Mac each week Pri Yearly mediocre interest rates by

It’s really no coincidence the display regarding adjustable-rates mortgages has a tendency to move in line which have mediocre home loan prices. As you can see a lot more than, Case prices was constantly lower than fixed costs an average of. And also as fixed home loan prices rise, adjustable-rates finance tend to build into the popularity. That’s exactly what we’ve noticed in 2022 at this point.

Adjustable-rates mortgages was much safer today

Adjustable-speed mortgage loans had previously been far riskier than simply he is now. Prior to 2008, the original fixed-price months on an arm (while you’d you to definitely) try most likely brief and you will is actually truly the only day you used to be covered in the full results of rising interest levels. But that has altered.

Today, the original, fixed-price period to your an arm last as long as 10 years. And when that time ends, you’ll find limits that limit how much cash your rate increases over time to greatly help always can invariably pay the financing no matter if pricing generally was rising.

Without a doubt, the reason Hands enjoys down costs is the fact you are taking to the a few of the chance when costs surge. However, consumers are much greatest shielded from that chance than just it once were.

Arm rate hats bring safety

Each bank sets its small print for varying-price mortgages, very you’re going to have to look at your loan agreement for facts. However, Fingers today are not render three types of price caps you to definitely manage consumers out-of unreasonable rate nature hikes. Really Arms provides:

- A cap about precisely how far their price increases at the stop of your own repaired-rates several months. It can’t meet or exceed the brand new cover, in spite of how large interest levels features risen

- Other limit on the next annual modifications, definition your price can just only boost because of the a quantity for each season

- A third cap about how exactly large your price may go more than the complete lifetime of their home loan. Which covers homeowners from enjoying its pricing increase astronomically in case the atic upswing

Without a doubt, you have still got certain connection with higher rates. But these protections help ensure individuals will always be in a position to manage their property money no matter if prices rise.

Indeed, borrowers having fun with Arm financing often have so you’re able to be considered considering the fully listed rate. Which means the financial institution often make certain you would be able to make costs regardless of if the Sleeve price were to see the limitation limit. So it rule helps to ensure homeowners would not default on the financing in the event the rates increase dramatically.

Was a varying-price financial wise when you look at the 2022?

While buying your forever household, discover nonetheless actual well worth in the a fixed-speed home mortgage. You have an ensured price and you will commission to the long lasting, offering way more shelter in your budget. And when costs slide later, almost always there is the choice in order to re-finance.

While doing so, when you are yes possible circulate within this five so you can a decade – which is, contained in this an ARM’s fixed-rates several months – you need to seriously speak about varying-rates mortgages.

At all, as to why pay much more to help you secure a rate to own 30 years whenever you could pay shorter to help you lock they with the level of ages you can inhabit the home? For the majority, that is a zero-brainer.

Discuss your options having a mortgage lender to understand exactly what costs you qualify for and decide if a supply is the proper home loan for your requirements.

Preferred Content

What contained with the Home loan Profile webpages is actually for informative intentions only and is not a marketing to possess circumstances given by Full Beaker. The fresh new viewpoints and views shown herein are those of one’s journalist and do not mirror the insurance policy or position of Complete Jar, their officers, mother, otherwise associates.